Missouri Farm Bureau Health Plans

For over 100 years, Missouri Farm Bureau (MOFB) has been known for enhancing the quality of life of our members. We are member-led and have a rich history of protecting and promoting the interests of farmers, rural communities, and all Missourians. MOFB has a proven track-record of providing first-class member services and risk protection products. Continuing with our mission of service, we are focused on providing affordable, high-quality health coverage to our members.

For over 100 years, Missouri Farm Bureau (MOFB) has been known for enhancing the quality of life of our members. We are member-led and have a rich history of protecting and promoting the interests of farmers, rural communities, and all Missourians. MOFB has a proven track-record of providing first-class member services and risk protection products. Continuing with our mission of service, we are focused on providing affordable, high-quality health coverage to our members.

Affordable health coverage is a significant barrier for beginning farmers who are trying to make ends meet. Oftentimes beginning producers cannot farm full-time because they must keep an off-farm job for benefits. It is commonplace among farm families for one spouse to maintain an off-farm job solely for access to employer-provided health insurance. There are also many examples of families opting to go without coverage altogether, simply because they cannot afford the limited options available today. Farmers, entrepreneurs, and families must have health coverage in order to protect their risk and maintain a high quality of life. Access to affordable and quality health coverage is essential to bringing the next generation home and helping our communities thrive.

MOFB members are calling for additional individual and family health coverage options due to the skyrocketing costs of traditional insurance. Farmers and other self-employed individuals are especially hard-hit by the lack of competitive health coverage options, since they often do not have access to employer-provided plans and may not qualify for federal subsidies on the Affordable Care Act (ACA) individual marketplace.

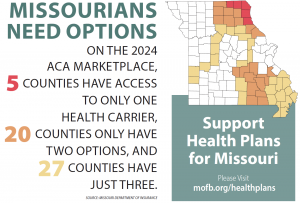

The lack of options is compounded for those who live in rural areas. In many rural counties, there are few traditional insurance providers on the individual marketplace. This results in little competition and cost-prohibitive plans. On the 2024 Missouri ACA marketplace, five counties have access to only one health insurance carrier, 20 counties have access to only two health insurance carriers, and 27 have three carrier serving their county. Oftentimes, the options available simply do not pencil out for individual and families seeking coverage.

Offering another affordable, quality health coverage option will reduce the number of uninsured Missourians. The plans are proven in other Midwest states, financially secure, available to members without threat of cancellation, and will offer many high-quality traditional health coverage features.

The status quo is not working for many Farm Bureau members, especially farm families. Representative Kurtis Gregory (HB 2082) and Senator Sandy Crawford (SB 925) have filed legislation to bring Farm Bureau Health Plans to Missouri.

Let your State Senator and Representative know that you support Farm Bureau Health Plans! Take action now and share your support in the Action Center.

Q: What are Farm Bureau Health Plans?

A: Farm Bureau health plans are a health coverage option for individuals and families under the age of 65. The plans are only available to Farm Bureau members. These plans function similarly to traditional insurance for both members and medical providers. The plans offer multiple coverage options (including hospitalization, preventative services, prescription drug coverage, emergency services, Teladoc, health savings accounts, and more) which can be tailored to meet members’ needs. Eligible MOFB members would have access to a nationwide provider network and MOFB would work with reinsurance and third-party administration partners to facilitate the plans and ensure members’ claims are paid correctly.

While these plans function as health coverage, they are not insurance and are therefore not subject to regulation under the Affordable Care Act (ACA) and other state mandates. Unlike the ACA, there are no designated open enrollment periods. MOFB members can apply at any time.

Q: Has this model been implemented in other states?

A: Yes, eight other states have made this option available to Farm Bureau members. Tennessee Farm Bureau has offered health plans to their members for over 75 years. Since 2010, five other state Farm Bureaus have received legislative approval and stood up programs to offer health plans to their members (Iowa, Kansas, Indiana, South Dakota and Texas). Two other states (Arkansas and North Dakota) received legislative approval in 2023 and are developing programs to bring coverage options to their members.

Q: What is the expected cost-savings?

A: Individual rates are anticipated to be 30 percent less than similar unsubsidized coverage available on the individual marketplace. Family plans can experience even more cost-savings. Rates can be affected by underwriting and are unique to each member and the policy selected. However, rates will not increase for individuals or families over time based on their changing medical history. Rates may be adjusted based on the age of the member, overall “group” health, and the continued rising cost of health care.

Q: Why are these health plans more affordable than traditional health insurance?

A: Each applicant will be individually rated based on their medical history, which will allow MOFB to offer coverage at a more affordable rate than similar coverage under the ACA. To achieve those savings, some applicants may not be offered a health benefit plan. In other states, approximately nine out of ten applicants are offered a plan. Regardless of pre-existing conditions, children under the age of 18 will be offered coverage on family plans. In the event that someone is not offered the health benefit plan they applied for because of a pre-existing condition, all options currently available in the marketplace are still on the table for them. This is simply another option to cover more lives in Missouri.

These plans are also more affordable because they utilize a six- or twelve-month waiting period before covering medical expenses associated with pre-existing conditions. However, once the waiting period has lapsed, all eligible treatments will be covered. It is worth emphasizing the waiting period applies only to pre-existing medical conditions, all new conditions and emergencies are covered on day one of coverage.

Q: What would a health benefit plan cover?

A: While not yet finalized, plans would offer variable coverage options that could be tailored to meet members’ needs. For an idea of what Missouri Farm Bureau Health Plans may look like, check out the options provided by Tennessee Farm Bureau Health Plans and Kansas Farm Bureau Health Plans.

Q: What happens if a member gets sick? Will they lose coverage or experience rate increases?

A: Once a member is offered a plan, the contract will not be cancelled for any medical event. As long as the member continues to pay the plan premium and maintains their MOFB membership, they will continue to receive their selected level of coverage. The plans will have no annual or lifetime limits.

Premiums will not change based on an individual’s changing medical conditions, but rates may increase as the individual ages or as the “group” performance changes. “Group” means all of the persons who purchase the same plan.